Investeringstips - Champagne - 2. maj 2019

Perfect timing for investment in Salon

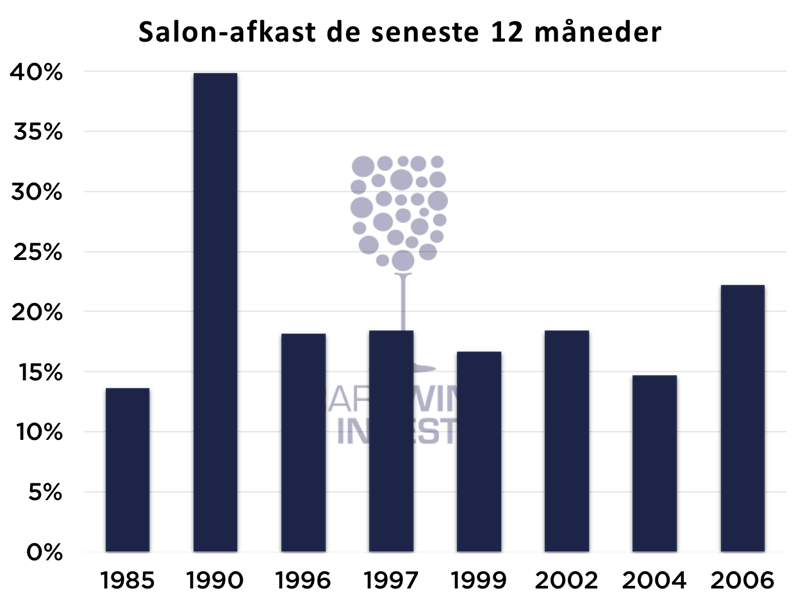

In the past 12 months Salon has on average risen by 18,4% while Salon vintage 2006 have risen by 22%. But Salon still holds great potential for investment!

Salon – Presently the best champagne investment

Prices in Champagne have risen by 10.4% in the past 12 months. Salon has on average risen 18.4% while Salon vintage 2006, which this investment tip is about, has risen by 22%.

Coveted and sought after, but only released in extremely small quantities, has made Salon a really strong investment. The potential of Salon in itself is large, as the figures above show, but the timing may be better than ever, as Salon hides an extraordinarily good investment case, where the keyword is called vintage 2008.

Short story for the world's perhaps best champagne

While large champagne houses like Roederer, Bollinger and Krug have hundreds of years of history, Salon has a relatively short history, at least seen from a Champagne-perspective. Salon has, in a relatively short time, manifested itself as the producer of some of the most acclaimed and coveted Champagnes in the world.

For The history of Salon, as we know it today, is under a hundred years old, and its beginning is no longer back than the beginning of the last century.

Eugène-Aimé Salon was a happy Champagne amateur with a mission to produce good champagne for his own and friends pleasure. The initiate production at the time would today be regarded as a hobby production, but Eugène-Aimé Salon was a visionary and ambitious, and quickly set a goal to produce the first "pure" champagne, as an alternative to Champagnes' traditional Blending.

In 1905, Eugène-Aimé Salon was ready with what is today recognized as the first vintage of champagne exclusively made by Chardonnay and Salon was hereby the creator of the Blanc-de-blancs.

After the First World War (1914-1918), Eugène-Aimé Salon was urged to think bigger and to capitalize from its successful champagne production. This led to the founding of the Champagne house Salon in 1921. Due to Eugène-Aimé Salons' pervergence and extremely high standards for quality, Salon quickly became go-to champagne at the legendary Maxim's Restaurant in Paris, and Salon quickly became the premier choice among the quality conscious clientele.

Eugène-Aimé Salon led the Salon until his death in 1943, and with his champagne he left an imprint on the world, which is said to symbolize his great generosity and his quest for a happier life.

In 1988, the family-owned champagne house Laurent-Perrier acquired majority ownership of Salon, which then became the sister company of the fifth oldest Champagne house in the world, Delamotte. Despite the changes in ownership and that the house is no longer family owned, the original heritage and traditions of Salons are safeguarded, and is therefore still a first choice among the world's champagne condeers.

The surprise of the Eagle's Nest

It is said that Adolf Hitler was a great admirer and fan of the Salons champagnes and when the notorious Nazi stronghold Kehlsteinhause (Eagle's Nest) was taken over by the Allied forces in 1945, over 200 bottles of Salon vintage 1928 were found in the cellars of the house – loots that The Nazis had taken when they occupied France. One of the first Allied soldiers to arrive at the Kehlsteinhause (and of course opened and tasted on a bottle of vintage 1928 Salon) was the Frenchman Bernard de Nonancourt. He later came to lead the champagne house Laurent-Perrier. If the meeting with Salon, became Bernard’s way into Champagne and how much influence he had on the fact that Laurent-Perrier in 1988 bought Salon, is not known.

Wonder if it was pure coincidence?

Created Rare

Salon was from the early years created with the desire to produce a unique champagne exclusively on Grand Cru grapes from Le Mesnil-sur-Ogers. Only the absolute best years should become the Salon, because quality should surpass everything else.

Le Mesnil-sur-Ogers is one of the 17 Grand Cru areas of Champagne, which currently accounts for only 9% of the total area. The remaining 91% consists of Premier Cru and village fields.

Today the grapes for Salon continue to exclusively come from this area and the Salon therefore still meets the strict requirements of the founder regarding the quality. The strict requirement is exemplified in that since 1921, only 41 vintages of Salon has been released.

The high demands for quality are exemplified if you compare that with other large producers. While in the period 1990-2009, Dom Pérignon has produced vintage champagne in 15 out of 20 possible vintages, the Salon has only released 8 vintages during the same period.

Thus, the Salon discards more than half of possible vintages, which testifies to an extreme requirement of quality!

Apart from the fact that the Salon is only produced in the absolute best years, only about 60,000 bottles and 5,000 magnum bottles are released in each vintage, which is a negligible proportion compared to the large house's productions in the millions.

In effect, this means that Salon in the past 20 years has just released about half a million bottles of champagne – and under two million bottles over the course of a century!

One can therefore safely say that the Salon is already extremely rare on release and, by its very nature, only becomes even harder to acquire over time.

Salon has risen 18.4% in the past 12 months

We have previously recommended Salon for investment and, as a result of this, have many portfolios with large positions in Salon, which have delivered stable returns over the past several years. Lately, it has been speeding up, and the return in the last 12 months has been at 18.4% across vintages.

Read our previous recommendation here:

Published 1/9 2018: Salon – A must-have in a wine portfolio

Published 3/11 2017: Salon – The creator of the Blanc-de-Blancs

As can be seen in the diagram below, Salon has delivered fine returns, somewhat evenly spread over the different vintages. This has resulted in an average price increase of 18.4%.

The best performer is vintage 1990, which has delivered a return of an astounding 40% in the last 12 months. The reason for the great increases in price in vintage 1990, however, is that this vintage is exposed to high demand both among collectors and quality conscious champagne drinkers who recognize the excellent quality and drinking maturity of this vintage. This demand for the very scarce quantities of 1990 Salon has contributed to the major rise in prices.

The special status of Salons also becomes clear when comparing price changes in Champagne in general. The average increase in Salon prices of 18,4% are impressive against the return in Champagne* of 10.4% in the past 12 months.

*Liv-Ex Champagne 50

Price developments in the past 12 months of Salon in portfolios managed by Rare Wine Invest

Price developments in the past 12 months of Salon in portfolios managed by Rare Wine Invest

+ 27 % since first investment time in November 2017

In addition to the general price rises across the Salon vintages, the good rates for vintage 2006 can also be read directly in our previous investment tips. Those who invested at our first Salon tip have thus been able to enjoy a price increase of over 27% in the 18 months since we first recommended Salon. Those who invested in September have received a return of just below 13% in only 6 months.

| Investment tip: | 3/11 2017 | 1/9 2018 | NOW | |

|---|---|---|---|---|

| Pris: | € 345 | € 390 | € 440 |

In addition to Salon’s extremely high quality, extremely limited availability and historical investment suitability, there is yet another great potential hidden in the champagnes from Salon just around the corner.

Salon has not yet released their vintage 2008 and is expected to do so at the end of 2019 or at the beginning of 2020.

As we have witnessed several times in the past, the vintage 2008 from the Champagne houses has been released at prices that have been equally as towering as the expectations of the vintage. High release prices of vintage 2008 Cristal from Roederer, for example, led to the prices of the other vintages of Cristal rose, and only six months after the release of the vintage 2008, the prices of Cristal vintage 2006, 2007 and 2009 all increased by more than 30%.

In addition, it can be revealed that the 2008 Salon is not being released in a usual way, which can help to boost price developments. 2008 Salon will be released exclusively on Magnum bottles and due to a very small production, production is limited to just 5,000-10,000 magnum bottles, of which half is expected to be released, while the rest is saved in the House's own cellar.

Top quality in vintage 2006

Salons' High quality is clearly manifested in vintage 2006. The world's four biggest wine critics agree and distribute their towering scores as follows:

| CRITIC | Richard Juhlin | Wine Advocate | Anthony Galloni | James Suckling |

|---|---|---|---|---|

| 2006 Salon | 95 | 96+ | 97 | 97 |

Longest Salon drought since 1995

The world, despite the limited quantities, has been accustomed to the fact that there is usually no more than a couple of years between the Salon releases, and if running out of Salon the next vintage was typically within reach.

This will soon come to change and the champagne drinkers, after the release of vintage 2008 Salon, must wait a long time for next vintage.

When Salon releases their vintage 2008, some years will go by before Salon again releases a new vintage, it is known that the House will not release the Salon in the Vintage 2009, 2010, 2011 and 2012 and possibly even the vintage of 2013 too. This, by its very nature, gives a long Salon drought, which has not been seen since the vintage 1995 replaced vintage 1990 after 4 vintages without releases.

If this is to be put into perspective, one can rightly compare such years without release in Champagne, with several consecutive years of total failure of the burgundy harvest – an almost unthinkable thought, but a reality for Salon. Four years of drought will undeniably affect the prices of the bottles that have not yet been drunk, and this is particularly interesting in an investment perspective.

Rare Wine Invest believes

Wine-knowers and champagne-connoisseurs unite around the Salon which is recognized among the best of the absolute best champagnes in the world. The salon has, across all vintages, delivered good and stable returns and there is no evidence that this will change, so we continue to recommend every vintage of Salon for investment.

The reason for the timing of this investment tip is to be found in the prospect of the release of the house vintage 2008. The timing prior to the release of the vintage 2008 is perfectly aligned in relation to the investment in Salon.

An expected high release price of vintage 2008, which is expected to be on several thousand euros for a magnum bottle, could create the basis for increased focus on and interest in the other vintages from Salon, which in that perspective will look cheap.

The combination of a narrow historical vintage and the prospect of at least four years of drought are putting up for some great increases in price at Salon.

Surely it is, however, that Salon is an extremely coveted champagne, which historically, across the vintages, has been a good investment that Rare Wine Invest's investors have benefited from.

In addition, it is estimated that the impending 2008 release, along with a coming Salon-drought, can have a significant positive impact on prices across all Salon vintages.

2006 Salon available to investment

Rare Wine Invest has obtained another parcel of 2006 Salon, which is sold exclusively for investment. With almost two years since the release of vintage 2006 and a vintage 2007, which already 6 months ago replaced the year 2006 as being the current available vintage Salon on the open market, this could be the last chance to buy vintage 2006 in solid quantities at this price.

| Vintage | Wine | Vol. | Packaging | Qty. | Price* |

|---|---|---|---|---|---|

| 2006 | Salon | 750 | OWC6 | 126 | € 440 |

| 2006 | Salon | 1.500 | OWC1 | 12 | € 1.150 |

*All prices are in EUR ex. Customs duties, taxes and VAT, delivery to bond warehouse. Prices incl. VAT and duty are sent on request. The wines are sold only in whole boxes, unless otherwise stated and the price is per bottle. A total investment of min. EUR 10.000 is required.